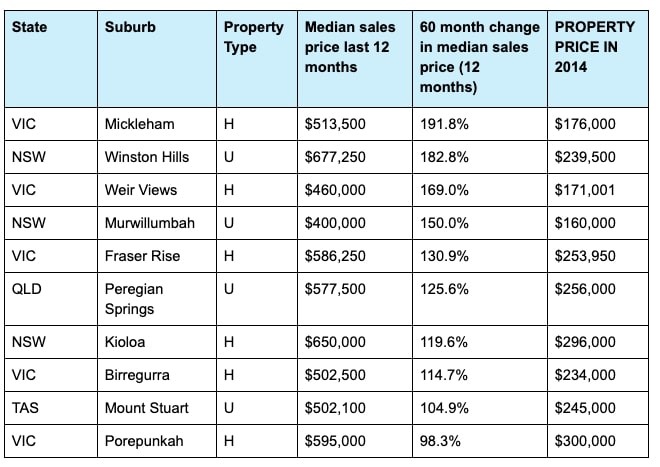

Prices have skyrocketed in these 10 Australian suburbs over the last 5 years, showing just how crazy the real estate boom has been

The property boom is not confined to Sydney and Melbourne.

How cinematography in ‘Casino Royale’ revolutionized the Bond franchise

Generally, cinematography has been an afterthought for James Bond films. However, when the franchise was rebooted with 2006’s “Casino Royale” (starring Daniel Craig), the cinematography…

While those two cities have been two of the biggest beneficiaries – or victims, depending on your perspective – of price growth in recent years, they’re certainly not alone.

In research provided exclusively to Business Insider Australia, comparison site Finder has found the ten Australian suburbs you should have invested five years ago. While it’s topped by outer city suburbs, it also shows the sheer breadth of the property boom, with regional Victoria, New South Wales South Coast, and Queensland’s Sunshine coast all getting a guernsey.

“It is no surprise that properties in Sydney in Melbourne [have shown] the most investment promise as these cities have seen a meteoric rise in value over the last five years,” Finder insights manager Graham Cooke told Business Insider Australia. “Most of the profit in these suburbs comes from the property prices rising rather than the rental income, which just shows how important it is to monitor sales prices in your area.”

Interestingly, the data shows that in both Sydney and Melbourne it’s been suburbs on the outer periphery where prices have picked up the most speed. In saying that, almost two-thirds of around 3,800 suburbs analysed turned a profit over the five year period, according to the data by property research house CoreLogic. That’s despite a two-year slump in Sydney and an 18-month one in Melbourne.

While the returns detailed here might be enviable, it goes without saying of course that it’s no indicator of future success.

“As we saw in 2019, prices do not always rise – and with other economic factors looking a little grim – it pays to do your research before jumping into the housing market,” Cooke said.

You can, of course, bask in the glow of what could have been if you’d just bought in up in one of these 10 suburbs. You can also scroll to the bottom if you like your data hard and fast.

1. Mickleham, Victoria

At the top of the list, and exemplifying how insane the Australian property market can be, we have Mickleham, 29 kilometres north of Melbourne’s CBD.

You could have picked up a house for just $176,000 back in 2014, and frankly, you will have wished you had. In the last five years, prices have risen an astounding 191% – meaning you could expect to sell the same property for $513,000. For your troubles, you’d pocket nearly $340,000. Before stamp duty, of course.

2. Winston Hills, New South Wales

For Sydney buyers, you would have wished you’d looked at Winston Hills, an outer Hills Shire suburb of Sydney, 28 kilometres west of the CBD. In the last five years, unit prices have moved 182% north. Your $239,500 outlay in 2014 would be worth around $677,250 today.

3. Weir Views, Victoria

It’s unlikely many buyers were looking to little known Weir Views back in 2014, coming in more than 40 kilometres west of Melbourne’s CBD. You might kick yourself you didn’t however. A $171,000 house would have returned 169% over five years, jumping to $460K.

4. Murwillumbah, New South Wales

Murwillumbah, nestled on the New South Wales side of the Queensland border, was the best investment you could have made outside of a major city. Units that were once $160,000 are now selling for $400,000 – a tasty 150% return.

5. Fraser Rise, Victoria

Fraser Rise, another new suburb in Melbourne’s north-west, 30 odd kilometres from the CBD, comes in at number five. Houses were being snapped up for around $253,000 in 2014. Today they’re selling for nearly $590,000. Not bad.

6. Peregian Springs, Queensland

Just falling outside the top five is the first Queensland suburb, Peregian Springs, on the Sunshine Coast, around 20 kilometres north of Maroochydore. Units that were selling for $256,000 have more than doubled to $577,000. Better than a kick in the head, my grandmother would say.

7. Kiola, New South Wales

Following that, we’re back south of the border in Kiola, on New South Wales’ South Coast, about a 30-minute drive north of Bateman’s Bay. A house, potentially a holiday house for you and yours, could have been bought in 2014 and got a little change for $300,000. If you could bear selling the family beach house, you’d at least make around $350,000 in profit. Worth the price of your kids’ tears? You decide.

8. Birregurra, Victoria

Speaking of potential family getaways, try Birregurra, a half-hour drive inland from Lorne on Victoria’s Great Ocean Road. There might not be any waves in Birregurra but in hindsight you wouldn’t turn down the opportunity to invest. Back in 2014, houses were $234,000. Last year you could have sold it for over $500,000.

9. Mount Stuart, Tasmania

Given Hobart’s meteoric rise in recent years, it’s a shock that one of its suburbs wasn’t higher. Units in Mount Stuart, tucked at the foot of Mount Wellington, were going for $245,000 once. Today, you’d need $502,000 to get a look in.

10. Porepunkah, Victoria Look, no one blames you for not investing in one of these gems five years ago, but certainly you wouldn’t have guessed Porepunkah, around an hour south of Wodonga, was on the up and up. While I’m sure it’s lovely all year round, Porepunkah is the most regional of this whole list. Didn’t stop houses rising a cheeky 98.3% over the last five years, pocking almost $300,000 from a sale today.